The study, “Upgrading California’s Climate Policy – How SB775 could make carbon pricing more equitable”, by Max Henrion, PhD and Tony Sirna, explores the economic effects of the carbon price and dividend and compares them to an extension of current cap and trade policy.

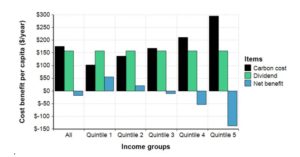

A key finding is that SB775 would make cap and trade a progressive fiscal policy, with a majority of low- and middle-income households ending up with a net financial benefit under the program. In contrast, an extension of the current cap and trade would be a regressive policy with low- and middle-income households costs increasing from the carbon price by a larger percentage of income than high-income households.

Read the full study: Upgrading California’s Climate Policy – How SB775 could make carbon pricing more equitable